The Rise of Renters: Why Property Investors Hold the Key to Australia’s Housing Future

As a residential property investor, you’re more essential to the future of housing than ever before. A recent report by AHURI highlights a growing trend: more Australians are becoming “forever renters,” with the proportion of renters projected to rise to 40% of the population in the coming decades. For decades, Australia enjoyed an unusually high…

As a residential property investor, you’re more essential to the future of housing than ever before. A recent report by AHURI highlights a growing trend: more Australians are becoming “forever renters,” with the proportion of renters projected to rise to 40% of the population in the coming decades.

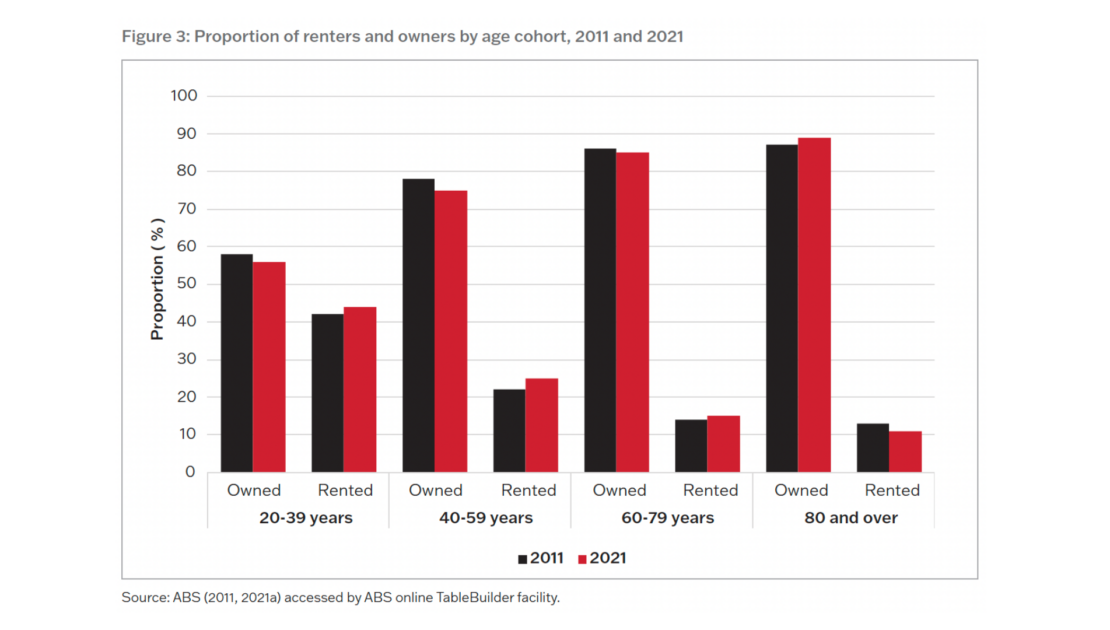

For decades, Australia enjoyed an unusually high rate of homeownership, peaking at 70% in the 1970s. But this was an anomaly driven by specific economic conditions, and the tide is turning. Like in Europe and parts of the U.S., renting long-term is becoming a more permanent reality for many Australians. Even if government housing expands, it will only cover a fraction of those who need it. The rest? They’ll rely on private rental properties.

Here’s the opportunity: As the number of renters grows, so does the demand for well-managed, quality rental properties. And that’s where you come in. These investments not only contribute to resolving Australia’s housing crisis but also strengthen your family’s financial future, creating a lasting legacy.

Being a successful property investor requires active decision-making around location, property type, and tenant needs. Increased density options like terrace housing, initially met with scepticism, are proving vital in solving housing demand challenges. Increased density options like terrace housing, which were initially met with scepticism, are proving to be key in meeting these demands.

At Investor Property, we leverage our insights into market trends, growth areas, and shifting housing needs to guide your investment strategy. We’ll help you identify opportunities, refine your investment approach, and ensure your portfolio is aligned with the long-term trends shaping Australia’s housing landscape.

Book a session today and let’s work together to make your investments as impactful as they are profitable.