HOUSE VALUES & INTEREST RATES - WHAT’S ON THE RISE?

Making news this week was the release of CoreLogic’s analysis comparing the property market’s performance two years before and after the cycle of interest rate rises. As you might expect, we have a few comments regarding this information as well as the commentary surrounding it. Firstly, the fact that we’re seeing analysis made on the…

Making news this week was the release of CoreLogic’s analysis comparing the property market’s performance two years before and after the cycle of interest rate rises.

As you might expect, we have a few comments regarding this information as well as the commentary surrounding it.

Firstly, the fact that we’re seeing analysis made on the correlation between interest rates and housing prices further cements the fact that the so-called ‘macro’ picture is, in fact, myopic.

Looking at the big picture without fully grasping the factors and outcomes is just assessing data in the context of the model, despite how many times that model has been proven wrong. It might be statistically correct but a factual lie. It fails the “2 Rule Test” (Rule 1, don’t fool yourself. Rule 2, you are the easiest person to fool).

If you’re working with limited levers based on arbitrary guidelines, and those guidelines are also antiquated and inadequate, sticking to them will likely lead to negative outcomes rather than positive ones.This is the case of actions by all levels of Government and the likes of APRA and the RBA when it comes to residential property and housing our population…

In the context of the CoreLogic report, we can see from the data that despite interest rate rises and restricted access to funding, property prices have continued to rise but not as a blanket rule across all regions, because the price of property is actually irrelevant to the rate of interest payable!! You can see in this article that the journalist and the analysts are trying to find some level of correlation and meaning between two different sets of data but it simply does not exist.

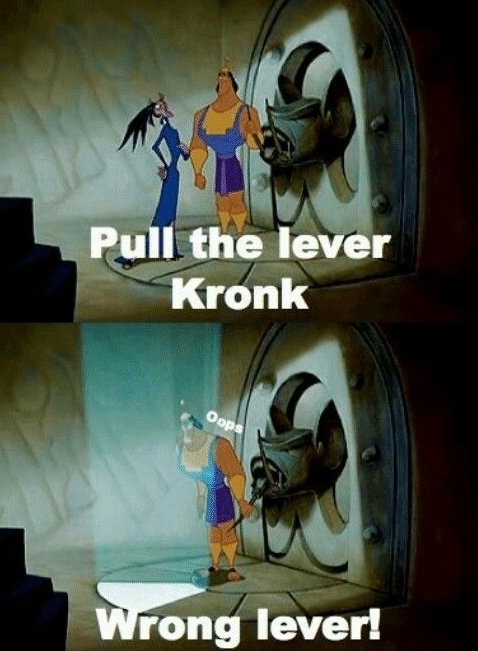

Prices are rising, and mucking around with interest rates wont change this. Why? Well for one (as we have commented here many times), the whole interest rate system is busted… yet again they pulled the wrong lever!

Further to this, the data they’re using to determine property values is a median average which doesn’t give a true reflection of the market activity, just the pricing of the middle sale in a given period. If you’ve been following Investor Property for a while now, you’ll know how we feel about medians, but if you’re unsure why we’re hating on this mathematical equation then take a look at this super quick explainer video we put together.

In short, looking at median prices doesn’t factor in changing buyer behaviours or stock availability – for example, in one period there might be a lot of luxury apartments for sale, and in another period a new release of lower priced townhouses might flood the market. If we look at the median sales over these two periods and compare then the data would show a dramatic drop in median house prices but they’re totally different built form and value – it’s not comparing apples with apples and it’s useless at best, deceiving at worst. The wider you go in the sample, the less relevance it has (we have debunked the myth of the ‘Australian’/’State’ or even ‘City’ housing market multiple times).

Regardless, if you find any value in the CoreLogic analysis, the summary position of a lack of correlation between rates and house prices are of no surprise to our team who have consistently kept their finger on the pulse of the various Australian property markets and economic and social factors that influence them. Through understanding how the government bodies, regulators and decision makers tend to operate, we expected and publicly predicted (unnecessary) interest rate rises and climbing property values over the last few years. We shared in September 2022 what we believed would unfold over 2023 and into 2024 to 2026 with relation to interest rates and prices. While the first 6 months of our predictions were at odds with the consensus view, once again our predictions have stood the test of time.

We still stand by these predictions today.

We also mentioned the rapid move to regional areas during Covid and that for most it would be a ‘sugar hit’ in growth that would revert to a more normalised pattern, albeit higher overall than the past due to affordability challenges. We also pointed out we believed the Sunshine Coast would be one of the stand out regions that would buck this trend with high growth due to increasing demand and decreasing real supply. Again this is being proven in the data and on the streets.

While Australia is facing a growing imbalance between supply and demand, the regions in the most demand are seeing increasing prices and rents.

If we compare the supply and demand principle to lettuce, like we saw during the floods when lettuce crops were ruined and transport paths were disrupted, the demand outweighed supply and the price of lettuce was exorbitant. But there were options for people to choose alternatives to lettuce, like cabbage, or simply go without. Then when lettuce was able to be grown again and delivered to the stores, the prices balanced.

Like food, housing (shelter) is a fundamental need, yet there are no simple alternatives. The housing version of cabbage are the tent villages we see popping up everywhere. We also can’t grow more houses like we would lettuce as the conditions improve. Between government policy, funding constraints and limits within the construction supply chain, the conditions are akin to the lettuce fields being washed into the ocean and they have to reclaim the land before they can start growing again.

So what does all this mean? We’re frustrated. Noise like these media articles doesn’t help. Action does.

You are part of the solution; not only in championing change, but taking the opportunity in the crisis to be part of the help house others and secure your own financial future.

Those that can get into property in the right areas with the right funding model will benefit from the growing property values, and with such demand for rentals the returns make such great sense with high yields and low vacancy rates. However, it is important to have the intel to identify what the ‘right’ properties are, and that’s what we do best so reach out to our team if it’s time to review your strategy and opportunities.

The best way to maximise your outcomes while reducing your risk is to work with the experts – you know, someone with a 20 year track record.