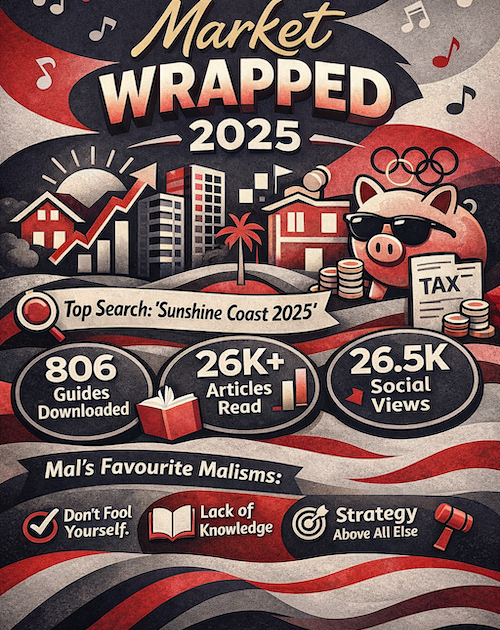

Investor Property: Market Wrapped 2025

If Spotify Wrapped tells you what you listened to… This is what investors were paying attention to. Before the year fully wraps up, here’s your Property Market Wrapped; a snapshot of the questions, insights and conversations that shaped investor thinking over the past year with our Investor Property digital assets. 🔍 Most Searched Question of…

If Spotify Wrapped tells you what you listened to…

This is what investors were paying attention to.

Before the year fully wraps up, here’s your Property Market Wrapped; a snapshot of the questions, insights and conversations that shaped investor thinking over the past year with our Investor Property digital assets.

🔍 Most Searched Question of the Year that saw keen Googlers land on our site:

“Sunshine Coast property market forecast 2025”

No surprises here. Investors weren’t chasing hype, they were chasing clarity.

What’s next? Where is risk forming? And where does opportunity remain structurally sound?

That single question says a lot about where mindset has shifted: from reaction to strategy.

🏆 Top Articles on Repeat

These were the tracks on heavy rotation:

- Property Predictions for 2025: Why the Sunshine Coast Remains #1

A clear favourite, and for good reason. This piece cut through noise and reinforced why fundamentals still matter more than headlines. - Tax-Smart Deductions for Property Investors

Because making money is one thing, but keeping it is another. - How Will the 2032 Olympics Affect Our Tight Property Market?

Not speculation. Context. Timing. Long-term implications.

Together, these tell us something important: Investors are thinking long-term, tax-aware, and region-specific.

📘 Knowledge Was Downloaded (A Lot)

800+ free investor guides downloaded

That’s 800+ people choosing education over emotion.

And it reinforces what we say often: The biggest risk in property isn’t interest rates, policy changes or the media cycle. It’s lack of knowledge.

📲 Social Content That Stopped the Scroll

Here’s what really resonated across platforms:

- Facebook (Top Reel): “Where Australian property growth is, and where it isn’t”

Clear, direct, and data-backed. - Instagram (Top Reel): “A 5% deposit sounds great… but here’s the catch”

Because shortcuts always deserve scrutiny. - TikTok (Top Performer): “A new tax for having a spare bedroom!”

Proof that policy confusion, and misinformation, still needs unpacking.

🎤 Mal’s Favourite “Malisms” on Repeat

Every year has its standout lyrics. For us, these were the ones that kept resurfacing because they cut straight to the truth.

Most Played Malisms:

🎯 “Does it meet the two-rule test?”

- Rule 1: Don’t fool yourself.

- Rule 2: You’re the easiest person to fool.

A reminder that good investing starts with brutal honesty, especially about our own biases.

📚 “The biggest risk is a lack of knowledge.”

Markets move. Policies change. But uninformed decisions remain the most expensive mistake of all.

🧭 “Strategy above all else.”

Headlines are loud. Strategy is quiet, but it’s what actually compounds over time.

🏛️ “Don’t confuse political intent for policy accuracy or delivery.”

Good intentions don’t guarantee good outcomes.

Investors need to focus on what actually happens, not what’s promised.

Also, sometimes we’re simply served dumb policies by muppet politicians. The right strategy can see us rise above it all and succeed regardless.

📊 By the Numbers

- 26,000+ readers across our weekly articles and website content updates

- 26,500+ social views of our videos and reels

- One consistent theme: investors looking past noise and toward evidence-based decisions

🎯 The Big Takeaway from This Year’s Wrapped

The market didn’t reward panic. It rewarded prepared investors.

Those who took the time to understand:

- structural undersupply

- tax strategy

- long-term demand drivers

- and why the Sunshine Coast continues to stand apart

…are the ones best positioned heading into 2026.

👉 Your Next Move

If you haven’t already, bookmark our insights hub, download the free guides, and use the summer break to get properly informed.

When we return in the new year, our team will be ready to help you:

- pressure-test your assumptions

- refine your strategy

- and map out a clear action plan

Because in property, as this year has shown, the best-performing investors are the best-informed ones.

🎶 That’s a wrap.