SHOULD WE PREPARE FOR WAR?

If you keep an eye on property news you probably would have noticed the claims this week from Rich Dad Poor Dad author Robert Kiyosaki who warned investors to prepare for ‘war’. To recap, the well-known writer said the world is on the brink of a major change…explaining China was ascending to take over US leadership…

If you keep an eye on property news you probably would have noticed the claims this week from Rich Dad Poor Dad author Robert Kiyosaki who warned investors to prepare for ‘war’.

To recap, the well-known writer said the world is on the brink of a major change…explaining China was ascending to take over US leadership of the global economy and this was increasing the threat of violent conflict. Mr Kiyosaki believes a crash is coming and it will be worse than 2008 (although he did not elaborate on when it would occur or exactly how severe the crash would be). He cautioned that property prices may ‘tank’, and prudent investors need to be prepared.

When reading articles like this, it’s important to ask clarifying questions such as; What is Robert Kiyosaki known for? Is he an expert in war? How likely is the threat to occur?

We acknowlege there is pressure from China, and note that Bernard Salt has done a great job analysing the situation but what is the likelihood of open conflict?

Our chief operating officer Mal Cayley isn’t just extremely skilled when it comes to property, he also has an extensive military background. It’s for this reason we’ve asked him what he thinks about the situation and the claims.

“Conflict between nations is constant, whether it’s economic, trade or subversion – it’s not just open conflict. Of course, all nations seek to further their national interest. Like passing a budget, military force is a tool to achieve those aims. Open conflict is very costly, and few genuinely seek it as an alternative – especially large nation-states. They may use the threat of war and seek to instigate conflict through smaller nations, however, it is unlikely widespread open conflict will occur.

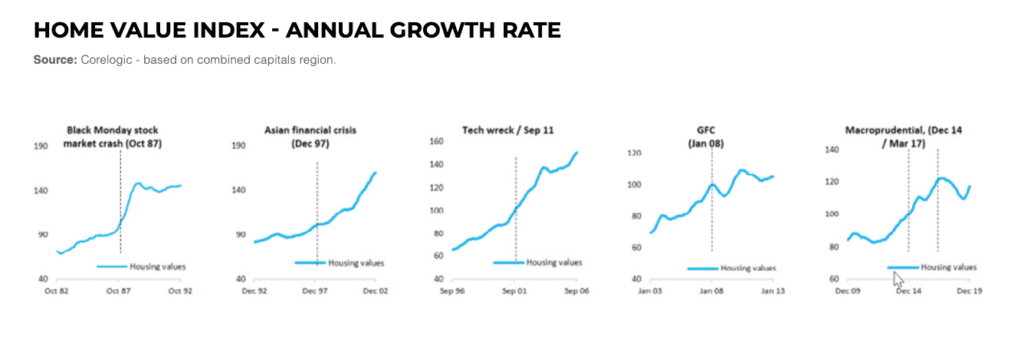

“As we’ve previously mentioned in our ebook, in times of economic challenges property prices have actually proven to go up – see graphs below. Hypothetically if there was open conflict, or a significant economic crash, what we’ve seen in the past is money moving to property.

In times of crisis, where do people feel most secure? At home.

Just as home feels safe, many people find property to be safe place to put their money, and we see investments tend to move to the security of bricks and mortar. In times of crisis (as we’re seeing now during this health crisis) the cost of funds often reduces, which makes property investment even more attractive during these times.

China is building its military capacity and will likely soon be the largest economy in the world. It has posed a threat to security for years, such as the recent hacking attacks on government information systems and has been waging psychological warfare for a very long time. Think about its trade sanctions. It will continue to seek to secure its supply lines and that may include some elements of conflict or ‘war’ as others may put it. I just don’t see a large-scale open conflict against the west as some descriptions imply. Keep in mind, as China grows in strength, opposing nations will work together and collaborate to negate that threat and the chance of conflict. War is possible, but it is ‘likely’?”

In summary, it’s not surprising that China is working on increasing its international standing. We believe it’s unlikely they will resort to open conflict, rather they will look to secure their supply chains and alliances.

IF this has any impact on the economy, it’s likely property will still fare well as a safe asset.

There will always be wars and rumours of wars, but it’s very unlikely we will see open conflict with China. For now, it’s safe to say, there’s no need to panic.

Here at Direct Collective and Investor Property, we are passionate about helping people achieve financial freedom through property. We pride ourselves on providing a well-researched, no-nonsense approach to our work and are dedicated to being the voice of reason in uncertain times.

Contact us today to organise a time to meet with our expert coaches to discuss how we can help you achieve your residential property investment goals.