The Housing Crisis Needs More Investors, Not Less. Here’s the Evidence

The latest push from unions to target property tax breaks might make for a catchy headline, but it’s yet another example of agenda-driven politics putting optics ahead of outcomes. The rhetoric paints investors as the villains of the housing market. The evidence shows the opposite: we need more investors, not fewer. According to the State…

The latest push from unions to target property tax breaks might make for a catchy headline, but it’s yet another example of agenda-driven politics putting optics ahead of outcomes. The rhetoric paints investors as the villains of the housing market. The evidence shows the opposite: we need more investors, not fewer.

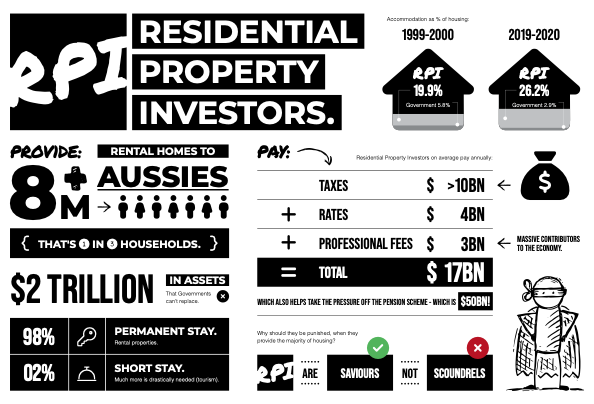

According to the State of the Housing System 2024, more than 30% of Australians rent their home, and the vast majority of those rentals – over 8 million Australians – are housed by private investors, not the government.

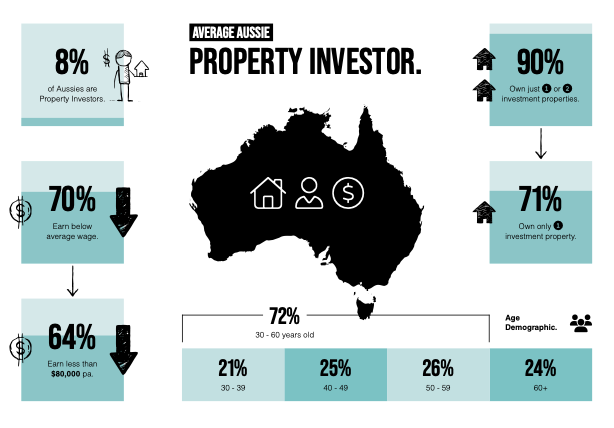

Government-provided housing has halved as a share of the total over the past two decades, leaving everyday Aussies to fill the gap. These Aussies helping Aussies aren’t corporate moguls or multi-millionaires as the propaganda would have us believe; they’re typically 45-year-olds earning less than the average wage, owning just one investment property.

Yet the latest ACTU-backed proposal (among many others such as policies driven by the Greens) wants to dismantle the very incentives that keep these homes in the market.

Cause and Effect: The Data Doesn’t Lie

We’ve seen this before.

When APRA and policymakers have made it harder for investors to buy, the results have been crystal clear: fewer rentals, higher rents, and more homelessness. The so-called “wins” for affordability were short-lived; house ‘prices’ (or the almost useless tool that is used to explain house prices) may have dipped briefly based on macro data (in reality this didn’t happen at all – a story for another day) but then climbed again, driven by increasing demand for an even scarcer supply.

This isn’t just theory. Investor participation dropped sharply after APRA’s macroprudential interventions in 2014 – 2019, with rental stock growth collapsing in lockstep. The same flawed reasoning is now being rehashed, ignoring the lessons of the last decade.

Why Supply, Not Punishment, Is the Answer

Unions claim these changes will help first-home buyers. But here’s the reality – if a developer launches 100 new apartments, they can’t start without a certain volume of pre-sales. Owner-occupiers rarely buy off the plan. Without investors, the project doesn’t proceed. That means zero new homes for anyone.

Read more about the need for investors in our comprehensive property market report here.

Australia desperately needs to come together to address this crisis. Despite a general consensus that we don’t trust the government, many of the same people advocate for a government-only solution to the housing crisis. Do we really believe that the government, and not everyday Australians, are the solution? I think not.

It’s basic economics: you can’t solve a supply-side problem by attacking the very group that funds most of the new supply.

The Penicillin Problem

Imagine a young girl, desperately unwell. Her doctors prescribe penicillin, promising it will make her better. She takes the first dose, and her symptoms get worse.

Instead of reassessing the diagnosis or changing the treatment, the doctors double down. “Just keep taking it,” they insist. Dose after dose, her condition continues to deteriorate. The very thing meant to heal her is slowly killing her because she’s actually allergic to penicillin.

In the end, she doesn’t survive, not because her illness was untreatable, actually given time it would likely have come good by the natural healing properties of the body, but because the doctors believed the penicillin was the answer to a fast cure. Evidence would soon prove that the so-called ‘cure’ was actually a ‘cause’ of a whole new illness.

Sadly, this is a true story. It is also a true reflection of exactly what’s happening with some of the housing policies being pushed today. Measures brought in out of fear of a rapidly rising housing market (one that, if correctly understood, was actually limited to just 20% of the market and would have stabilised on its own) ended up slashing new housing supply and driving up rents. Now, those same measures are being re-prescribed as if they’re the cure. Like the penicillin example, uninformed practitioners are prescribing treatments that were wrong the first time, and repeating them will only deepen the crisis.

Policies that drive investors out of the market are the poison. Claiming they’re the solution is like prescribing penicillin to cure penicillin poisoning.

Our Challenge to the ACTU and anyone else claiming investors are the cause

We’re all for a debate, but let’s bring evidence, not slogans.

The offer stands: sit down at the table, compare the data, and prove us wrong. The facts are public. The impacts are measurable. The only thing missing is the political will to face them.

What This Means for Investors Right Now

These measures are unlikely to gain enough momentum to pass in full, but they do underline an important truth:

If you can invest now, you should.

Not just for your own financial future, but because doing so helps put more homes into the market when they’re needed most.

We’ve said it before, and it’s worth repeating: the quiet majority has let politicians and minority lobby groups dictate the housing narrative for too long. The result? A crisis that punishes renters, buyers, and future investors alike.

Right now, Australia doesn’t just need to hold onto the investors we have; we need more of them, and we need them buying and building more homes. It’s called SUPPLY!

Yes, we can revisit investor incentives one day. But that day is after we’ve fixed the supply problem, not before. Anything else is putting the cart before the horse.

It’s simple economics: the more housing there is, the more affordable it becomes. Cutting investor incentives now doesn’t just slow the market, it strangles supply, making homes scarcer and prices higher for everyone.

For the government, supporting investors is far more cost-effective than trying to build enough housing themselves (also taking pressure off of Super and adding to the economy). Every home an investor puts into the market is one less that the taxpayer has to fund with the same money, effectively producing 3 times the housing! With private investors already housing over 8 million Australians, the smart move is to empower them to do more, not less.

If you want to secure your future and be part of the solution, you need a strategy grounded in evidence and experience, not headlines and hearsay. That’s where we come in.

Contact our team for a free strategy session that could change the future for not only your family but for many others.