The Rates Didn’t Drop, Yet. Are You Ready for When They Do?

It’s Not Sudden. It’s Inevitable. After two interest rate cuts this year, one in February and another in May, many expected the Reserve Bank to cut again this month. They didn’t. But that doesn’t mean the pressure is off. Because here’s what we’re seeing: Preapprovals are climbing. Buyer enquiries are building. And most importantly, people…

It’s Not Sudden. It’s Inevitable.

After two interest rate cuts this year, one in February and another in May, many expected the Reserve Bank to cut again this month. They didn’t. But that doesn’t mean the pressure is off.

Because here’s what we’re seeing:

Preapprovals are climbing. Buyer enquiries are building. And most importantly, people aren’t waiting.

Why? Because they can’t afford to.

With more buyers than homes and the prospect of future rate cuts already baked into market confidence, the smart money is getting its strategy in place before conditions shift further. And as serviceability improves with each adjustment, demand will only rise.

So no, this isn’t a sudden turn in the market. It’s the exact pattern we’ve been warning about and preparing for for years.

We’ve Been Talking About This All Along

To understand what’s happening now, you’ve got to look at how we got here.

Back in 2007, the Property Council of Australia warned governments that housing affordability was already spiralling. They said:

“Many governments are in denial… They claim that interest rates are to blame, or that access to ready credit in a strong economy is the root cause. However… the cost of basic housing, or access to low-cost house+land packages… have escalated wildly on their watch.”

That was 18 years ago.

Fast forward to today, and it’s the same finger-pointing from those in power, still blaming “the market” for a crisis they created.

The truth is this: the system has been breaking for decades.

And in our last Sunshine Coast Property Market Update, we mapped the entire landscape and our next edition, currently in production, explores this even further. From government policy to planning delays, from funding constraints to construction blowouts, this isn’t just about demand. It’s about dysfunction.

A System Designed to Fail (And Who Pays the Price)

The graphic below says it all:

Developers (the ones desperately needed to provide new supply – all homes come from developers) are stuck in a tangle of inconsistent council policies, rising fees, construction code requirements, and finance blockages from regulators.

At the same time, buyers hit by higher interest rates and investor penalties have reduced capacity to participate, making pre-sales harder and developments less viable.

Add in state taxes, inflated land prices, and costly time delays, and it’s no surprise we don’t have enough homes.

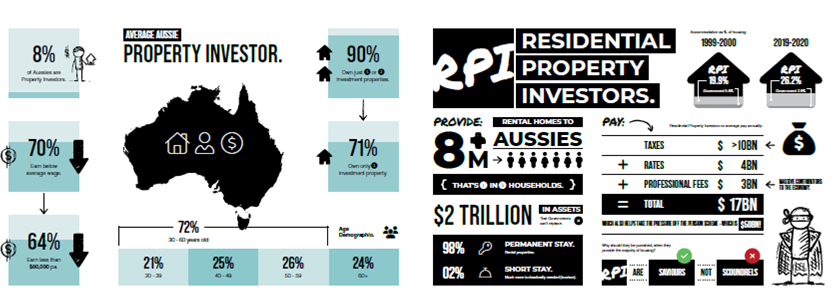

Investors: The Saviours, Not the Scoundrels

Despite all this, there’s one group keeping the rental market afloat, and it’s not the government.

It’s ordinary Australians. Investors.

The average investor is not a high-flying mogul; they’re everyday people earning less than six figures, trying to build a better future.

In fact:

- 70% earn below the national average income

- 64% earn under $100,000

- The majority own just one investment property

- 98% of residential investment properties are permanent homes for Australians

Together, they provide homes for more than 8 million Australians and contribute over $17 billion annually in tax, rates, and fees.

Together, they provide homes for more than 8 million Australians and contribute over $17 billion annually in tax, rates, and fees.

We’ve been saying this for years.

Now, more of the industry is finally starting to agree.

What Does It Mean for You?

Whether you’re a first-time buyer, a parent thinking ahead, or an investor recalibrating your plan, the message is clear:

- Act now. Preapprovals are already up. Prices are on the move. Waiting means paying more.

- If you’re developing, you need expert help to navigate this system. It’s complex, but it’s not impossible.

- SMSF investors have a major opportunity: property offers stability in an otherwise volatile financial landscape.

We have solutions for every stage, whether you’re just getting started or looking to scale.

Here’s What You Can Do Next:

Here’s What You Can Do Next:

The conditions may be complex, but with the right strategy, this is a moment of extraordinary potential. The key is acting before the rest of the market catches up.