WHY WE DON’T WANT INTEREST RATES TO DROP RIGHT NOW

Some people could read that headline and wonder why in the world we would think that – aren’t low interest rates ideal? So let’s explain. Since the GFC in 2008 interest rates have been low, looking to stimulate the economy. Few remember paying variable rates in the 9% range leading up to that time. Nor…

Some people could read that headline and wonder why in the world we would think that – aren’t low interest rates ideal? So let’s explain.

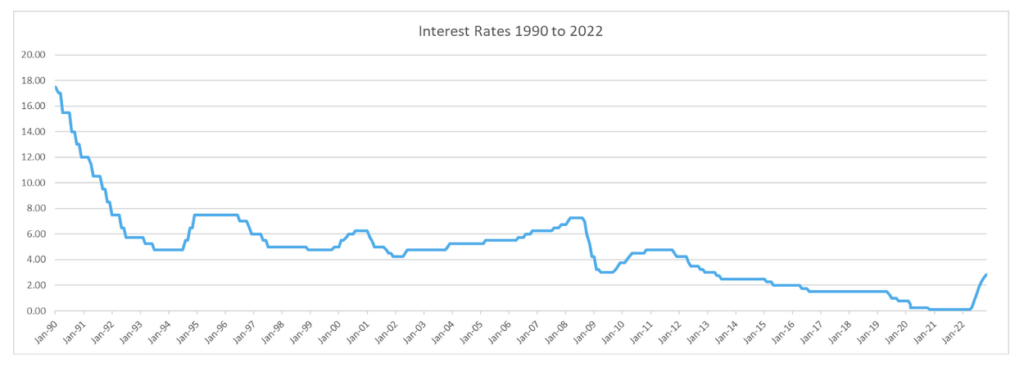

Since the GFC in 2008 interest rates have been low, looking to stimulate the economy. Few remember paying variable rates in the 9% range leading up to that time. Nor the fact that as interest rates rose from 4.25% to 7.25% over 2001 to 2008 property prices more than doubled.

Long term interest rates average 3.85%.

From the share market crash in 2008 it took 12 years for stocks to reach their prior high. Property however continued to increase in value. The only real slow down came as a result of macroprudential regulation increasing from 2015.

Historically there is no correlation to interest rate increases and property market crashes despite the headlines. The challenge we have is that for more than 10 years interest rates have sat in the ‘stimulus’ category, well until recently when they fell into the ‘crisis’ category.

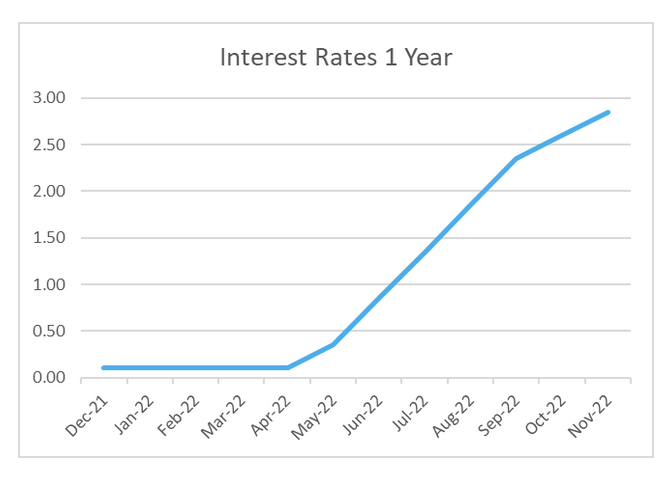

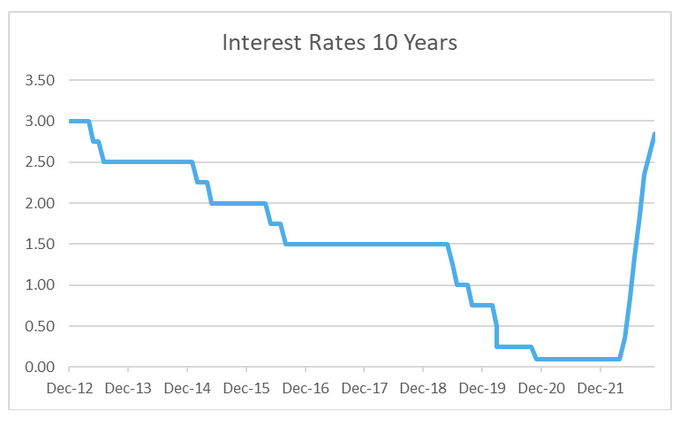

Two years ago, in November 2020, interest rates hit a record low of 0.10% in Australia and there they stayed until May this year. Since then interest rates have consecutively risen each month with cries of pending doom – in fairness if you were to look at it in a 12 month context it looks like a hockey stick about to knock something out of the park.

But if you look at it over the last 10 years, the data shows a return to normal.

Last week, the RBA raised the cash rate a further 25 basis points to 2.85%. In regards to issuing another increase (the 7th in a row), the Board said it is because inflation in Australia is too high. Over the year to September, the CPI inflation rate was 7.3%…the highest in more than 30 years.

“The Board has increased interest rates materially since May. This has been necessary to establish a more sustainable balance of demand and supply in the Australian economy to help return inflation to target. The Board expects to increase interest rates further over the period ahead. It is closely monitoring the global economy, household spending and wage and price-setting behaviour. The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market.”

The RBA expects inflation to further increase and peak around 8% later this year, before declining next year due to “the ongoing resolution of global supply-side problems, recent declines in some commodity prices and slower growth in demand”. Its priority is to return inflation to the 2-3% range. It said price stability is a prerequisite for a strong economy.

Now, while many households are likely tightening the budget due to the recent rate rises, what we need to remember is rates remain cheap. We have been spoiled over the last couple of years with record low rates, so it becomes easy to forget what ‘normal’ rates are. Thankfully, wages are also rising at the moment to help handle the rates and inflation.

So, in a hypothetical world, what would happen if rates dropped?

If rates dropped right now, it would not be good for our economy. It means the economy is slowing. From a property perspective if we look back at when rates dropped to a record low two years ago, what happened? A buying frenzy. Hundreds of people attended auctions and open homes, increasing prices and reducing product in the market. Making lending more affordable to more people, along with a massive undersupply and pent up demand is what contributed to the current housing crisis we are experiencing. Keep in mind, this hasn’t changed, people may have stopped purchasing out of fear but vacancy rates continue to drop because demand has not magically disappeared. People are paralysed by fear and some have reduced lending capacity (especially property investors due to the additional servicing requirements). At some point the cork has to pop from all this pressure, it’s likely to happen as soon as either rates come down or there is an easing in macroprudential regulation.

What does this all mean for the housing market?

As mentioned before, rates rising does not mean the housing market is going to crash. It is likely rates could remain at current levels for an extended period of time which is good, because they are at a more normalised level. As for the market, every area is different as it is all about the fundamentals. Economy, demand and supply. Some might actually come back a little in value…most will remain flat…and some will outperform. We categorise the Sunshine Coast in the latter as it has the foundations to achieve what no other city in Australia can.

What is happening is not the doomsday view we are seeing reported in the media as of late. According to Canstar, based on the latest predictions, the cash rate in Australia is expected to climb to a peak of up to 3.35%. That’s lower than the long term average rate of 3.85%. While it may be tougher for those who got their first mortgage within the last couple of years and they have not experienced a rate rise, it is definitely not anything out of the normal.

Contact one of our experienced property coaches today to discuss the opportunities available to you in the current market. With the cost of lending now higher, we can help you develop a solid investment strategy and help you navigate the constant changes to ensure you achieve your goals.