Spring has sprung and the price rises have begun!

As today marks the first day of Spring which is traditionally the beginning of when not only the weather but also the property market warms up again, it is timely that the PropTrack Home Price Index report was just released today sharing the latest data on housing prices across the country. While many backyard BBQ…

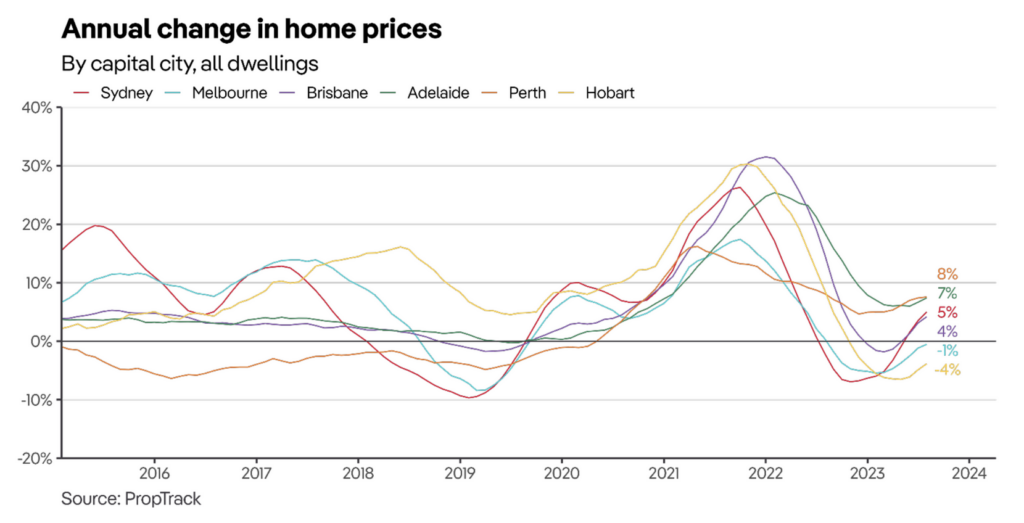

As today marks the first day of Spring which is traditionally the beginning of when not only the weather but also the property market warms up again, it is timely that the PropTrack Home Price Index report was just released today sharing the latest data on housing prices across the country.

While many backyard BBQ conversations may be predicting price drops and blaming interest rates for a falling property market, what we’re actually seeing in the real data is very different.

“August marked the eighth consecutive month of national home price growth. This is the longest period of consecutive monthly growth since the pandemic boom when prices rose for 23 months straight between May 2020 and March 2022.” … so it seems those interest rates have no impact on the property market’s growth.

What does this growth look like?

- National prices are now 2.64% higher than a year ago and up 3.51% so far this year.

- Regional QLD shows the highest growth in the country

- Growth since pre-pandemic is now 50% in just over 3 years

- The current market peak is the highest it’s ever been

For us, there were no real surprises here as the data is in line with what we’ve been privately researching and predicting for some time, but it is encouraging to see the current data supporting the recommendations and decisions we’ve made for ourselves and our clients’ investment strategies.

It’s all well and good to talk past, but I know you’re probably thinking, “What does it mean for the future?”

From this data and other research we perform we know that Queensland has the most undersupplied market, per person, in the country, yet the highest internal migration rate, and so with this continued imbalance of supply and demand we see regional Queensland continue to outperform all other regional centres across the country for growth.

Regional Queensland might appear to be a ‘shock’ stand out but here’s some context to show you why it makes sense:

- 80% of Victoria lives in greater Melbourne

- 80% of Victorian growth is in greater Melbourne

- 45% of QLD lives in greater Brisbane

- 42% of QLD growth is in Brisbane

- Victoria’s population fits 7 times into QLD … and many are moving to QLD!

Queensland regions are more important to the function and housing of the state than other states as the demand for the Queensland lifestyle sees more and more people move to the Sunshine State and look beyond the Brisbane City Centre for housing.

Just an hour outside of Brisbane, the Sunshine Coast and Gold Coast are two of the top 10 largest urban areas in the country. While still considered regional they get lumped in with the likes of Longreach (population of approx 3500 people in the centre of the state) in the datasets, so it’s fairly obvious that South East Queensland would outperform the rest.

Yet, all these comparisons and numbers don’t take into account what is happening in the larger, growing regional centres like the Sunshine Coast that are generating growth and opportunities beyond the national trends. Take a look at our comprehensive report that clearly outlines why the Sunshine Coast presents as Australia’s top potential residential property investment destination for the next decade.

With all this in mind, we don’t believe the market is ‘at peak’ as per the statements in the report. This conjures up thoughts of a tipping point before it falls again. In reality, it’s just the highest the market has been … well, until tomorrow … it’s heading north!

The other important point to note is that the reporting and comparisons are based on medians, and we’ve shared many times before how we feel about medians as they can hide the truth. The true story of what’s happening here on the Sunshine Coast is MORE than these stats can reveal.

What’s the scoop?

In short, our predictions are that the market will rise similar to 2020-2022 over 2024-2026 on the Sunshine Coast with capital growth and rental yields in this region likely to outperform anywhere else in Australia. 2026 will not be the ‘peak’, it will likely just be when the growth rate will slow.

Property will not get cheaper. It will not be easier to invest.

So should you have acted sooner? Yes.

Should you act now? Yes

Will you regret it if you don’t? Yes.

Big claim? We have been accurately making them for a long time.

Please talk to the team today. You have so much to gain, and a conversation with us is completely free and with no obligation. However, with the opportunities available and our insights into how you can build a successful property portfolio, many who speak to us can do more than they think, sooner than they think and it changes their lives.