Why is the housing and rental crisis worsening?

While many thought that the housing crisis would resolve when our lives returned to some sense of ‘normal’ post-covid-lockdowns, we knew that the real issue and the real solution had nothing to do with a pandemic. In addition to all the information we outline in our comprehensive research report about the housing crisis, one of…

While many thought that the housing crisis would resolve when our lives returned to some sense of ‘normal’ post-covid-lockdowns, we knew that the real issue and the real solution had nothing to do with a pandemic.

In addition to all the information we outline in our comprehensive research report about the housing crisis, one of our observations has been confirmed by new census data – the rentals in the region are disappearing in significant numbers.

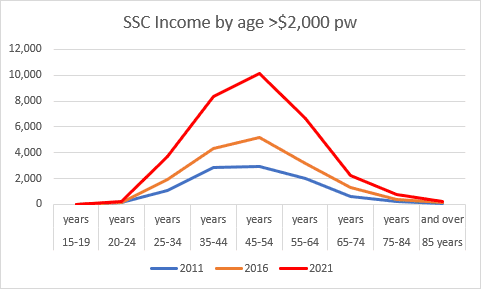

We’ve been watching for a while now as the Sunshine Coast becomes a Gen X dominant region and how this demographic shift relates to property and its impact on the community. While having a lot of Gen X can have its positives in terms of leadership (experience) and wealth for the region this is also putting a lot of pressure on the property market in a number of ways.

They’re buying up what’s available but not necessarily what they want just to secure a home in this region and their ability to spend more is outpricing others. Plus, most of the Gen X property purchasers are buying to live in the property rather than buying an investment to rent out. What we’ve anecdotally seen is the rapid decline in the number of rental properties, predominantly in the last few years.

This graph shows the wealthy Gen X group on the Sunshine Coast with the 45-54 age bracket earning the highest incomes and therefore able to afford to spend more on property.

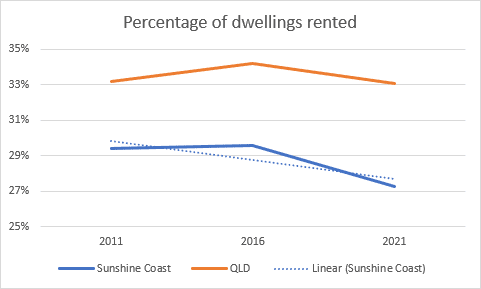

The Census has proven our fears with recent reports showing that across Queensland as a whole, but more specifically on the Sunshine Coast, the number of rentals has significantly dropped. Now, we’re not talking about rental vacancies here, we’re talking about total properties used for rentals.

We’ve previously discussed the massive undersupply of properties on the Sunshine Coast, but the most shocking and sickening part of that is the widening gap between owner-occupiers and renters.

Between 2016 and 2021 on the Sunshine Coast:

· The number of total housing stock increased by 17.8%

· Rental stock only increased by 8.6% by comparison – it should have increased at the same rate.

· On just the number of properties that were created between 2016 and 2021, we have lost 3,500 rentals to owner-occupiers

With a year since the census and the ratio of investor to owner-occupier sales increasing, we believe this number to be well over 4,000 rentals lost from the Sunshine Coast market in the last 6 years, predominantly in the last 2 years.

Part of the reason for the growing loss is that approximately 2/3 of homes going on the market for sale are investor stock and only 1/3 remain as rental properties after they’ve been sold.

With this disproportionate growth of owner-occupied and rental stock, the Sunshine Coast is effectively missing over 5,500 rental properties – to put this in perspective, that is half the size of the North Lakes estate in Brisbane’s North, or about 5 suburbs!

Even though the number of properties is increasing, it is not keeping up with the population growth and the undersupply is not addressed, but in fact, exacerbated.

With this new data and in the scheme of the undersupply that means that 80% of the undersupply on the Sunshine Coast relates to affordable properties, predominantly rental properties. That is why we have a rental crisis and a rising homelessness crisis.

Through this data, the Sunshine Coast is saying to the world “if you have money, you can live here”. The ‘Manhattan Effect’ as Bernard Salt described it when he presented on the market recently.

Investors are desperately needed to provide rental accommodation to help resolve this crisis in a win-win solution. Investors can help house members of the community while also seeing significant growth in their property assets as the undersupply of property is so great that it will still take decades to correct, and the market will continue to perform favourably for investors over this time.

Talk to our team about how you can be part of the solution and support your own wealth plan at the same time.