WHY THE POLLIES AND ECONOMISTS GET PROPERTY SO WRONG

New report reveals lack of real research regarding economic uncertainty and property performance In recent news from Corelogic, they outlined something we predicted long ago and have mentioned multiple times – the inverse relationship of house prices to confidence and increasing interest rates. Thanks for the extra evidence supporting what we have been saying; for…

New report reveals lack of real research regarding economic uncertainty and property performance

In recent news from Corelogic, they outlined something we predicted long ago and have mentioned multiple times – the inverse relationship of house prices to confidence and increasing interest rates. Thanks for the extra evidence supporting what we have been saying; for our readers, it is not the ‘shock’ news it is for the rest of the world.

Why was it a shock? Why is the consensus forward view often so at odds with ours? Because most of the economic models used require inputs that have a gaping, universe size black vacuuming hole (too much? we think not) in research. And, as we keep banging on about, “all risk comes from a lack of knowledge”.

The proof of this lack has been handed out by researchers for the University of New South Wales, Albert Agbeko Ahiadu and Rotimi Boluwatife Abidoye, who recently released their findings “Economic uncertainty and direct property performance: a systematic review using the SPAR-4-SLR protocol”. Quite a title and an intense read, but worthwhile as what it’s revealed makes sense for the frustrations of property investors – the relevant research simply does not exist.

The purpose of the research paper is expressed as: “This study systematically reviewed existing literature on the impact of economic uncertainty on property performance to highlight focus areas and spur future research amid unprecedented global uncertainty levels. Conceptually, uncertainty levels and environmental dynamism are related to investors’ risk judgement and decision-making”

Ok, so losing the academic language, what we’re looking at here is research that was undertaken to take a look at what official research is out there to support investors, economists and policymakers to understand what impact economic uncertainty has on the property market.

We know mass media and BBQ conversations love to fuel the fire of uncertainty and fear, but to make informed decisions and reduce risk, we need to rely on real and relevant research and insights from experienced individuals. It’s also important to critique sources and know how to analyse the information that is presented.

Some key insights we’ve gleaned from unpacking the report and reading into more than just their interpretations of the data:

- 82% of the material available is not related to Australia and the work that specifically does relate was not statistically significant

- 75% of the body of work in this research space was undertaken in the last 3 years, but over this timeframe, COVID has been a significant anomaly impacting every facet of our way of life. Therefore there is not enough depth of data and what is available is too sporadic to show any trend.

- A lot of reporting we hear about on property-related research refers to the USA because that’s where the majority of the research is undertaken. The trouble with that is while we have a similar land mass, Australia has only 6% of the population of the USA so the insights that apply to the USA are not as relatable to Australian property markets. The dispersion of our population means we are archipelagic in nature and have far more economic diversity and supply challenges. Australia is not the US, or like any other country, which brings its own unique set of opportunities and challenges. (Read more about that here)

So when we look to unpack real research to understand if an economic downturn or recession will see a flop in property values we can see from this research report that the data just isn’t there for Australian markets.

Economic modelling is predisposed to negative outcomes – if the ‘economists’ are telling you the market is going to rise, buy! It’s going to be better than they predicted. If they say its going to fall, don’t stress, it won’t be as bad as they say. Just look at any prediction longer than 6 months (outside of ours of course), the last 3 years. Ok, 20. The proof is in the pudding.

While we find this research report very interesting and enjoyed spending time going through the findings, we didn’t need this to know that the data on this particular property scenario hasn’t previously existed. We recognised long ago that the information being shared wasn’t helpful or relevant so we set about doing our own research and comparing data sets that we shared in previous editions of our Sunshine Coast Property Market Update and this news article.

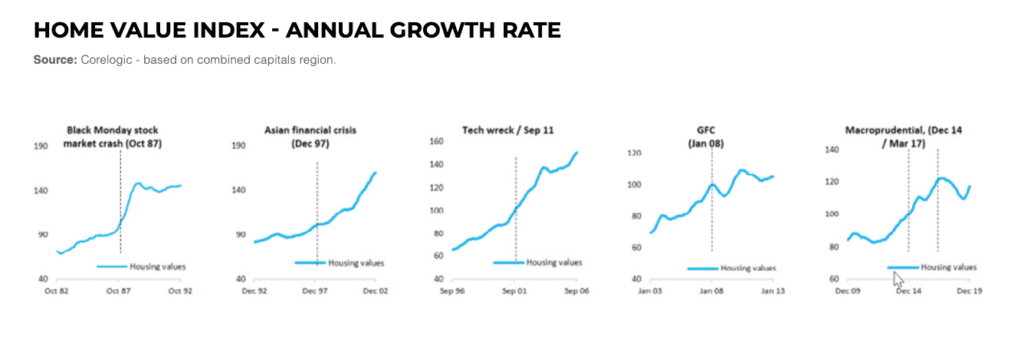

Like the recent Corelogic report, what they are awesome for is compiling historical data to show us what has happened. The extract below shows that in times of crisis and uncertainty, property prices in Australia have not faltered, in fact, they’ve continued to rise in value. In times of crisis people turn to what they feel is safe, for many people that is ‘home’ and so we see money move towards property.

What we do know is that economic uncertainty does make it harder to get credit which reduces investment and new dwelling volumes. Political uncertainty for property investors does reduce residential property investment volumes also. Recent political uncertainty, the attempt to placate government failure on residential property investors (those ‘nasty landlords’) and greedy cash grabbing on duty fees, rates and others has seen a significant decline in property investment volumes since 2015. That is the cause of the housing crisis. The reversal of which is also the answer …

Where other reports may present a different outcome to our insights, we draw your attention to the lack of relevant research and inputs that apply specifically to Australian markets and models and thereby their accuracy. Trying to apply economic models from other countries and markets is like trying to fix a diesel engine with a petrol engine mentality. While the ‘engine’ or ‘market’ may look similar to the untrained eye, it takes skilled people to understand the difference and apply the right approach to get the right outcomes.

The reality is, with the right support, inputs and team, you can make money in any market. The opportunity in declining investors and supply, yet with increasing demand for properties and from home renters means there are increasing opportunities for property investors.

We’re here to help build your team and provide those insights – standby for our latest property update to hit the streets next month.

In the interim, speak with your property coach or reach out to our team today if you’ve got questions about property and economic uncertainty, we can discuss the specifics of your property strategy in line with your goals and any external impacts that may influence your decisions.